MANTRA partners with UAE real estate giant MAG to tokenize $500 million in assets – FXStreet

- MANTRA announced its partnership with UAE real estate giant MAG on Wednesday via social media platform X.

- This collaboration introduces new investment opportunities for tokenized real estate worth $500 million in the flourishing Middle Eastern market.

- On-chain data shows that new Whales have accumulated 12.92 million OM tokens, and the exchange supply has decreased.

MANTRA announced its partnership with UAE real estate giant MAG on Wednesday via social media platform X, aiming to tokenize $500 million in real estate assets. Together, they plan to democratize luxury UAE real estate access through secure, yield-bearing vault products powered by MANTRA’s L1 technology.

This collaboration introduces new investment opportunities for tokenized real estate in the flourishing Middle Eastern market, solidifying MANTRA and MAG’s pivotal regional roles.

Buy/sell, rent/lease residential &

commercials real estate properties.

MAG Lifestyle Development CEO Talal Moafaq Al Gaddah emphasized that the alliance with MANTRA will enhance business operations and introduce forward-thinking products.

“MANTRA enables us to utilize cutting-edge blockchain technology to enhance the value and accessibility of our real estate offerings. This strategic partnership is crucial as we continue to innovate and lead in the luxury real estate sector,” he said.

UAE Real Estate Giant #MAG Partners with #MANTRA to Tokenize $500 Million in Real Estate Assets

✅ MANTRA and MAG will collaborate to democratize access to luxury UAE real estate using secure, yield-bearing vault products backed by MANTRA’s L1 technology.

This collaboration… pic.twitter.com/eVrwOUUa9H

— MANTRA – Tokenizing RWAs (@MANTRA_Chain) July 3, 2024

Data from Arkham Intelligence shows that two fresh wallets withdrew 12.922 million OM tokens worth $10.79 million on Wednesday.

In addition, on the same day, Santiment’s supply on exchanges declined from 135.57 million to 125.46 million. This decrease indicates that investors move OM tokens to wallets and reduce selling activity.

%20[08.57.22,%2004%20Jul,%202024]-638556669758606217.png)

OM Supply on Exchanges chart

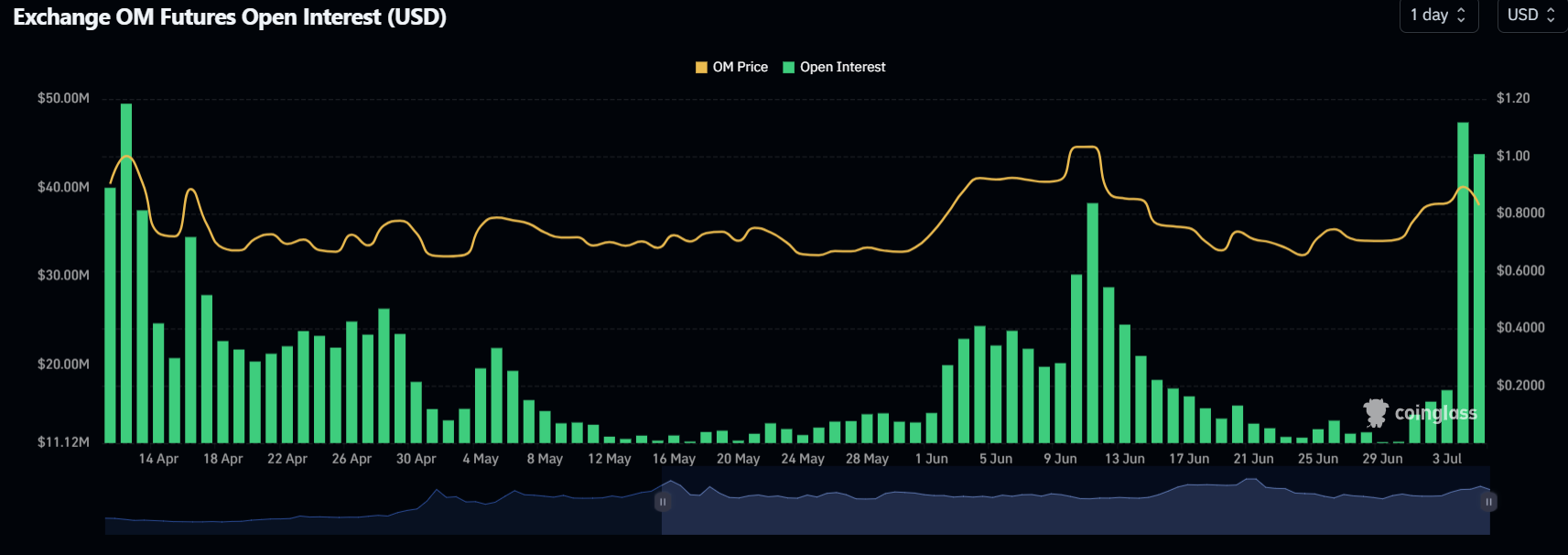

OM’s Open Interest data indicates a significant surge, climbing from $15.80 million on July 2 to $47.35 million on July 4, marking its highest level since mid-April. This uptick suggests an influx of new capital and heightened buying activity in the market.

OM Open Interest chart