California Housing Market 2024: Trends and Predictions – Norada Real Estate Investments

With its rapid growth of technology and the iconic coastline, California has been home to homebuyers for a very long time. Even as prices in some areas show new signs of instability, California’s housing market continues to be complex and active. This article covers current conditions in the California housing market, trends, affordability considerations, and regional variation.

So, How is the California Housing Market Doing in 2024?

California home prices are hitting record highs but sales are slowing down due to rising mortgage rates.

Buy/sell, rent/lease residential &

commercials real estate properties.

In May 2024, California’s housing market faced significant challenges due to the highest mortgage rates seen since late 2023. These elevated rates significantly dampened home sales on both a monthly and annual basis. Despite this, the statewide median home price exceeded $900,000 for the second consecutive month, setting yet another record high, as reported by the California Association of REALTORS® (C.A.R.).

Home Sales Data and Seasonal Adjustments

In May, the total number of closed escrow sales of existing, single-family detached homes in California was recorded at a seasonally adjusted annualized rate of 272,410. This figure, gathered from over 90 local REALTOR® associations and MLSs statewide, represents the expected total number of homes sold in 2024 if the sales pace from May continues throughout the year, adjusted for typical seasonal fluctuations.

Compared to April, May’s sales pace saw a slight dip of 1.1 percent from 275,540 homes. On an annual basis, sales were down 6.0 percent from the revised 289,860 homes sold in May 2023. For the 20th consecutive month, the sales pace remained below the 300,000-threshold, with year-to-date home sales staying flat.

Challenges and Opportunities in the Current Market

C.A.R. President Melanie Barker noted, “California home sales stalled in May as mortgage rates reached the highest level in five months and may have contributed to the slowdown in market activity.” However, she also pointed out that recent moderation in interest rates and improvements in housing inventory could present opportunities for motivated buyers to reenter the market before the peak homebuying season.

Record-High Median Home Prices

In May, the statewide median home price set a new record high, rising 8.7 percent from $835,280 in May 2023 to $908,040. This marked the 11th consecutive month of annual price increases in California. The median price was also 0.4 percent higher than April’s $904,210. Tight housing supply conditions and seasonal factors are expected to continue exerting upward pressure on home prices in the coming months.

Sales Trends by Price Segment

Stronger sales of higher-priced properties have significantly contributed to the growth in median prices. In May, sales in the million-dollar-and-higher market segment rose by 15.5 percent year-over-year, whereas sales in the sub-$500,000 segment declined by 12.2 percent. Homes priced above $1 million now constitute 36.6 percent of all sales, the highest share in at least the past five years.

Housing Supply Shortages and Market Competition

C.A.R. Senior Vice President and Chief Economist Jordan Levine commented, “A persistent shortage of homes for sale, particularly in the more affordable market segments, continued to push up California’s median home price to new record highs over the past couple of months.” With mortgage rates easing from recent peaks and market competition intensifying, there is potential for further growth in the statewide median price before the end of the summer.

Regional Housing Markets in California

Home Sales Trends

At the regional level, home sales in all major regions continued to soften when compared to their year-ago levels. Of the five major regions, two regions registered an improvement from a year ago, two recorded declines from the previous year, and one remained flat.

- The San Francisco Bay Area saw a sales increase of 4.3 percent.

- The Central Coast experienced a sales increase of 0.6 percent.

- Southern California posted a sales decrease of -1.0 percent.

- The Far North recorded a significant sales drop of -8.4 percent.

- The Central Valley was the only region where sales remained unchanged from a year ago, despite higher interest rates than in May 2023.

County-Level Sales Performance

Twenty-four of the 53 counties tracked by C.A.R. recorded sales declines from a year ago, with seven counties experiencing drops of more than 20 percent year-over-year. The counties with the most significant declines were:

- Tehama (-38.5 percent)

- Glenn (-36.8 percent)

- Del Norte (-31.6 percent)

In contrast, twenty-nine counties recorded sales increases from last year, with sixteen of those counties seeing jumps of more than 10 percent year-over-year. Notably:

- Plumas (70.6 percent)

- Mendocino (35.3 percent)

- Santa Barbara (33.6 percent)

This marked a step back from the previous month, when nearly three-quarters of all counties registered sales increases from a year ago.

Regional Median Price Trends

At the regional level, all major regions experienced an increase in their median price from a year ago. The regions with the most notable price jumps included:

- The San Francisco Bay Area with an increase of 11.9 percent.

- Southern California with an increase of 10.0 percent.

- The Central Coast saw a rise of 5.9 percent.

- The Far North experienced a gain of 5.3 percent.

- The Central Valley had a growth of 4.6 percent.

County-Level Median Price Changes

Home prices continued to grow on a year-over-year basis throughout the state as forty counties recorded a higher median price than what was recorded a year ago. The counties with the largest price increases included:

- Plumas (49.0 percent)

- Trinity (36.8 percent)

- Mariposa (31.4 percent)

Conversely, twelve counties registered a decline in median price from last year, with the most significant drops observed in:

- Del Norte (-27.0 percent)

- Calaveras (-14.4 percent)

- Lake (-11.7 percent)

California Real Estate Appreciation Trends

California real estate appreciation has historically been strong, but recent quarters show a potential shift. Long-term trends indicate the state remains a top performer compared to the national average. Let’s delve into data about long-term appreciation trends in the Golden State.

Recent Slowdown: A Departure from the Norm

Looking at the latest quarter (Q3 2023 to Q4 2023), we see a surprising trend – zero percent appreciation. This is a significant departure from California’s historical performance and reflects a potential shift in the market.

Long-Term Trends: Solid, But Not Unbeatable

Zooming out, we see a clearer picture. Over the past year (Q4 2022 to Q4 2023), appreciation sits at a modest 3.77%. This is lower than the national average, which currently ranks at number 3 compared to other states. However, when we expand the timeframe to 5 and 10 years, California’s performance becomes more impressive. Appreciation reaches 44.77% and 100.97% respectively, translating to an average annual rate of 7.68% and 7.23%. This puts California in the top tier for appreciation over these periods.

Historical Context: A Boom Followed by a Correction?

California’s real estate market has historically experienced significant growth spurts followed by periods of correction. The substantial appreciation seen over the past decade might be part of a natural cycle. Additionally, rising interest rates and economic factors could be contributing to the recent slowdown.

California vs. The Nation: A Tale of Two Markets

It’s important to remember that California is a diverse state with regional variations in appreciation rates. Coastal areas like San Francisco and Los Angeles tend to see higher appreciation compared to more inland regions. When compared to the national average, California consistently ranks in the top 10 for appreciation over extended periods. However, recent quarters show the state’s market may be experiencing a correction, aligning more closely with the national trend.

The future of California real estate appreciation remains uncertain. While the recent slowdown is notable, long-term trends suggest the state will likely continue to see appreciation above the national average. However, factors like interest rates, economic conditions, and housing inventory levels will significantly influence future price increases.

Challenges Facing the California Housing Market

Several factors have contributed to the challenges facing the California housing market. Here are some key factors that interact with each other, creating a complex and dynamic housing market in California.

1. High Demand and Limited Supply:

California has a high population density and strong economic growth, leading to a high demand for housing. However, there is a limited supply of available housing, particularly in desirable areas. This imbalance between supply and demand has driven up housing prices, making it difficult for many prospective buyers to afford homes.

2. Affordability Issues:

The high cost of housing in California has made homeownership less attainable for many residents. The median home price in the state is significantly higher than the national average. The combination of high home prices, rising interest rates, and stringent mortgage qualification rules has created affordability challenges for prospective buyers.

3. Strict Zoning and Land Use Regulations:

California has some of the most stringent zoning and land use regulations in the country. These regulations often restrict new construction and development, making it difficult to increase the housing supply to meet demand. This has resulted in a housing shortage and contributed to the rising prices.

4. Lack of Affordable Housing:

California faces a severe shortage of affordable housing, particularly in major cities. The cost of constructing affordable housing and the complex process of obtaining approvals and permits have hindered the development of affordable units. This has exacerbated the affordability crisis and led to a growing population of renters.

5. Economic Factors:

Economic conditions, such as job growth, wages, and interest rates, can significantly impact the housing market. Slowing economic growth or stagnant wages can dampen demand for housing, while rising interest rates can increase borrowing costs and dissuade potential buyers. These factors, in combination with high housing prices, have made it challenging for many Californians to enter the housing market.

6. Impact of Natural Disasters:

California is prone to natural disasters, including wildfires and earthquakes, which can damage or destroy homes and disrupt the housing market. Rebuilding efforts and insurance costs following these events can impact housing availability and affordability in affected areas.

7. Migration Patterns:

Migration patterns also play a role in the housing market. California has experienced both domestic and international migration, leading to increased demand for housing. However, in recent years, there has been a trend of net outmigration, with some residents leaving the state due to affordability concerns, congestion, and other factors. This can impact the supply and demand dynamics of the housing market.

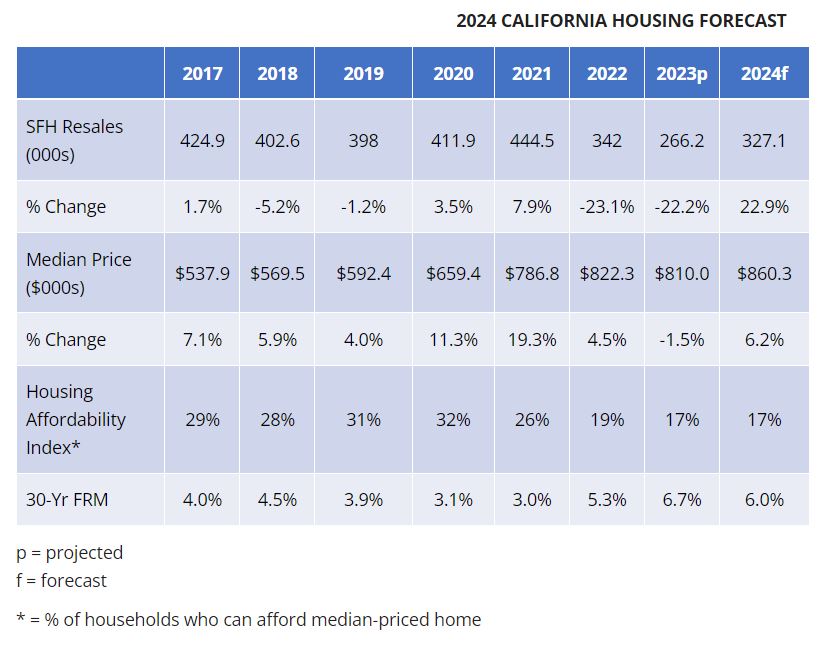

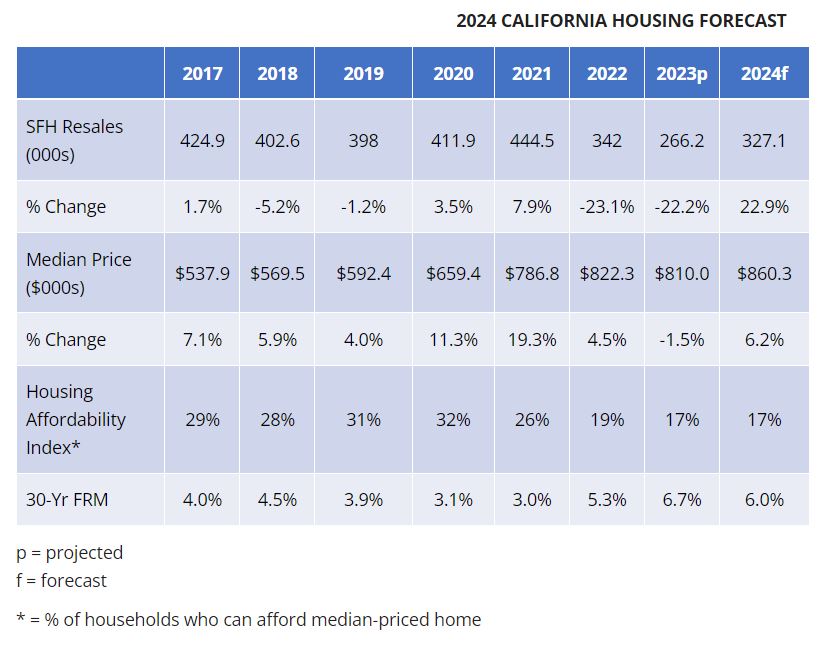

California Housing Market Predictions 2024

California‘s housing market appears poised for a comeback in 2024, according to the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) and their highly anticipated “2024 California Housing Market Forecast.” Let’s delve into the key projections:

Positive Outlook: Sales and Prices

- The forecast predicts a substantial jump of 22.9% in existing single-family home sales compared to 2023.

- This translates to an estimated 327,100 units sold in 2024, a significant increase from the projected 266,200 units in 2023.

- California’s median home price is anticipated to climb by 6.2% to $860,300 in 2024.

Driving Forces Behind the Rebound

- The forecast hinges on a decrease in mortgage rates due to slower economic growth and cooling inflation.

- This creates a more buyer-friendly environment, stimulating housing demand.

- While housing supply is expected to remain below typical levels, the slight increase in active listings could offer some relief.

Economic Factors and Market Dynamics

- The forecast considers economic indicators, including a modest 0.7% rise in the U.S. gross domestic product for 2024.

- California’s nonfarm job growth rate is estimated at 0.5%, while the unemployment rate may see a slight increase to 5.0% in 2024.

- Despite potential economic softening, a persistent housing shortage and competitive market are predicted to maintain upward pressure on home prices.

- The anticipated easing of monetary policy by the Federal Reserve Bank is expected to decrease mortgage rates throughout 2024, potentially giving buyers more financial flexibility.

Conclusion: Valuable Insights for All

The C.A.R.’s forecast paints a promising picture for the California housing market in 2024. However, it’s important to remember that these are projections. As the year unfolds, actual market performance will provide a clearer picture of these predictions’ accuracy. Regardless, this information offers valuable insights for both home buyers and sellers navigating the market in the coming year.

Should You Buy a House in California in 2024?

California’s sunshine and laid-back lifestyle lock in many a homebuyer’s sights. But is it a smart investment right now? Let’s crunch the numbers and explore the current California housing market to help you decide if this is the golden moment to make your move.

Market on the Move: Boom or Bust?

California’s housing market has a well-deserved reputation for soaring prices. The past decade has seen impressive appreciation, with some areas experiencing double-digit growth. However, the recent quarters have shown a shift. The breakneck pace has cooled, with some regions even experiencing slight dips. This could be a sign of a long-awaited correction or simply a temporary adjustment.

Numbers to Know: Crunch Time

So, what do the numbers tell us? Here’s a reality check: while the recent price hikes may have eased, California homes are still expensive. The statewide median price recently hit a record high of over $900,000. Couple that with rising interest rates, and monthly mortgage payments can feel like a hefty weight on your wallet.

Beyond the Numbers: Considering Your Needs

The decision to buy a house in California goes beyond cold, hard numbers. It’s about your long-term goals and financial health. Here are some key questions to ask yourself:

- Are you in it for the long haul? California real estate has historically been a good long-term investment. If you plan to stay put for at least five to seven years, you’ll weather any market fluctuations and likely see your home value appreciate.

- Can you handle the upfront costs? Don’t forget about the down payment, closing costs, and potential repairs. Having a healthy financial buffer will ease the initial strain.

- Is your job stable? Job security is crucial, especially in a state with a higher cost of living.

A Competitive Market: Be Prepared

California’s housing market is competitive, especially in desirable locations. Inventory remains tight, so be prepared to act fast and make competitive offers. Having a strong pre-approval from a reputable lender will put you ahead of the pack.

The California housing market has its complexities. Teaming up with a qualified real estate agent who understands the local market nuances is wise. They can guide you through the process, negotiate on your behalf, and help you find the perfect place that fits your budget and lifestyle.

The Verdict: It Depends

There’s no one-size-fits-all answer to the California housing question. If you’ve done your research, understand the market conditions, and are financially prepared, buying a house in California could be a great decision. But remember, it’s a significant investment, and it’s wise to approach it with both eyes open.

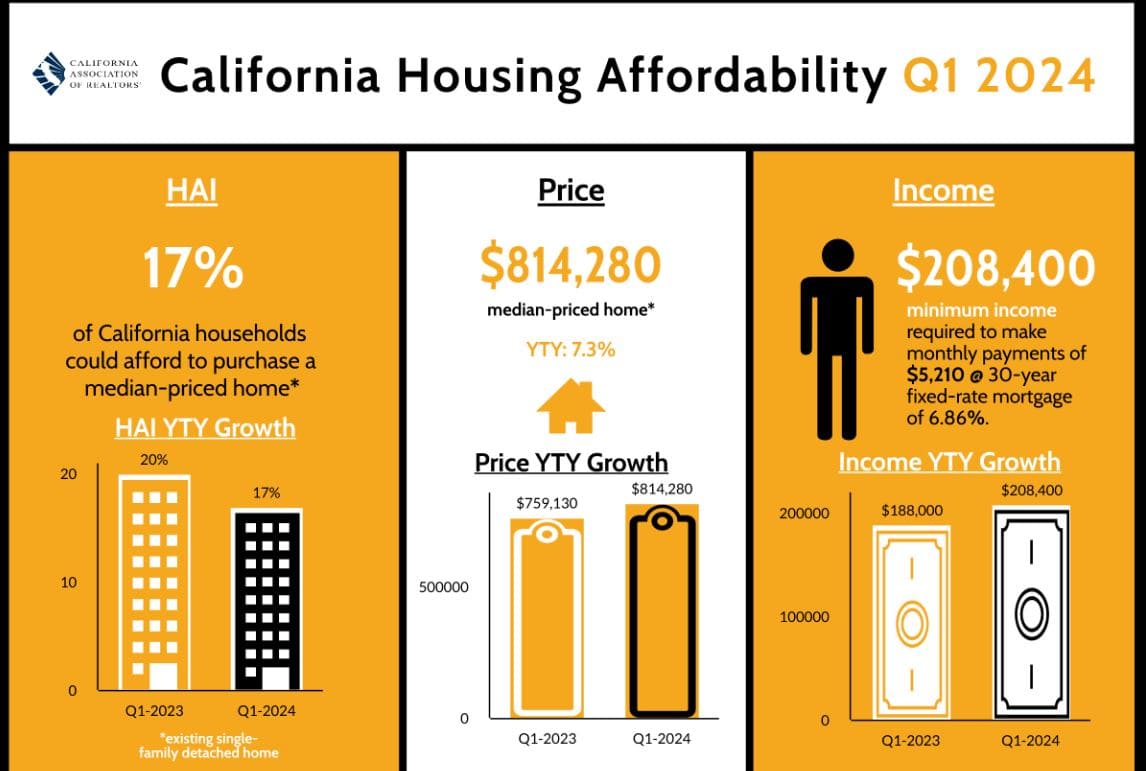

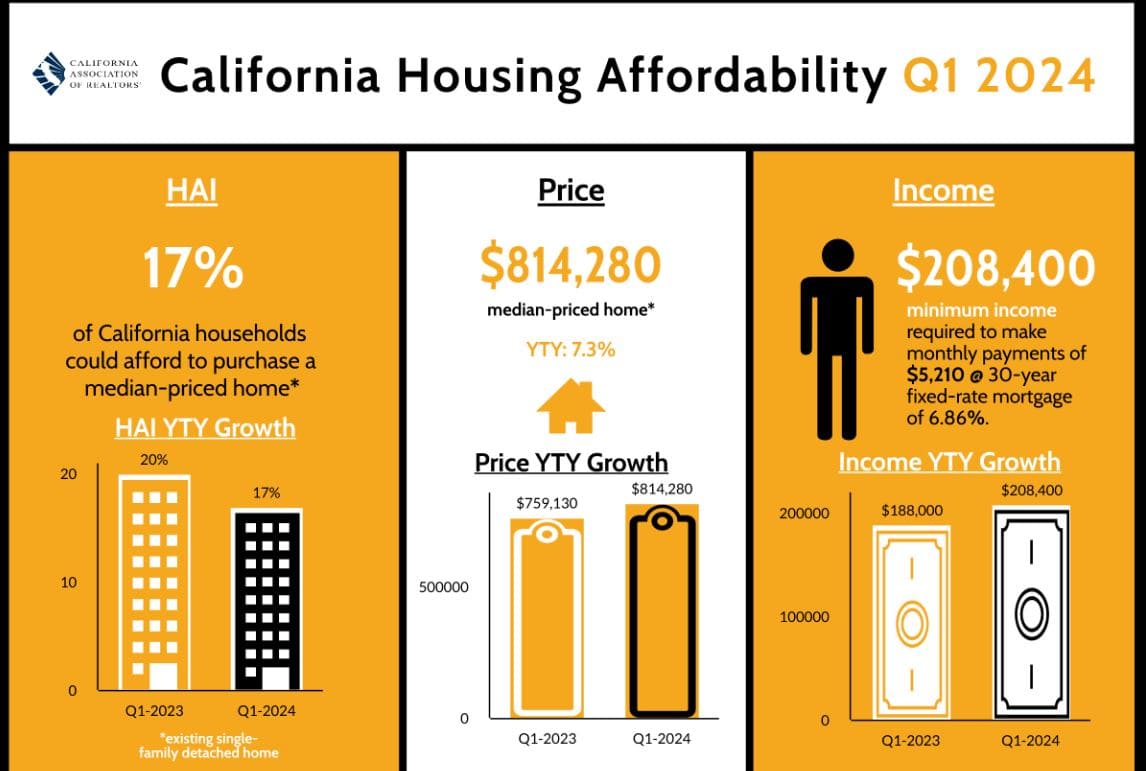

Is the California Housing Market Affordable?

Thinking about buying a house in California? The Golden State’s allure is undeniable, with its sunshine, beaches, and vibrant cities. But let’s be honest, navigating the California housing market can feel like traversing a financial minefield. To make an informed decision, it’s crucial to understand how affordable – or rather, unaffordable – things truly are.

The Numbers Game

There’s a reason why headlines might scream about a slight improvement in affordability based on the latest report by the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.). A small increase in the percentage of Californians who could manage a mortgage payment compared to the previous quarter is certainly positive news.

But before we get carried away, let’s crunch the numbers. A mere 17% of Californians could afford the median-priced single-family home in the first quarter of 2024. That’s a far cry from the more accessible market of 2012, when over half of Californians could qualify for a home loan.

Factors Behind Affordability Squeeze

So, what’s behind this affordability squeeze? It’s a double whammy of high home prices and rising interest rates. The median price tag for a single-family home in California sits at a staggering $814,280. To afford the monthly payments, you’d need a cool $208,400 in annual income – more than double the state’s median household income!

That’s a hefty down payment and a mortgage payment that could rival your rent for a luxury apartment.

Condos and townhomes offer a slightly brighter spot. The affordability index for these dwellings nudged up to 24%, meaning a quarter of Californians could swing the payments.

But again, the threshold remains high. An annual income of $167,600 is needed to purchase a median-priced condo, translating to a monthly payment of $4,190. That’s a significant chunk of change, especially for young professionals or first-time homebuyers.

California vs. National Average

The disparity between California and the national average is enough to make you do a double take. Nearly 40% of households nationwide can afford the median-priced home, requiring a significantly lower income of $99,600. It’s a stark reminder that the California dream comes with a hefty price tag.

Regional Affordability

The report also sheds light on the uneven distribution of affordability across the state. Lassen County reigns supreme as the most affordable, with an affordability index of 51%. Here, the minimum qualifying income for a home purchase is a much more manageable $66,000.

However, Lassen County might not be for everyone – job opportunities and proximity to desired amenities can be factors to consider. On the other end of the spectrum, counties like San Mateo and Santa Clara require a whopping half a million dollars (or more!) in annual income to buy a median-priced home.

These areas are hubs for innovation and technology, but for many Californians, homeownership in these regions seems like a distant fantasy.

Will Affordability Become Better in California?

While there’s a flicker of hope compared to the previous quarter, a year-over-year analysis paints a concerning picture. Housing affordability declined in 46 out of 58 counties. Rising home prices and stagnant wages are squeezing Californians out of the housing market, forcing them to make tough choices – delay homeownership, relocate to more affordable areas, or downsize their living space.

So, what does this mean for you as a potential homebuyer? Don’t be discouraged, but be realistic. Carefully assess your finances and explore all options. Consider areas with lower housing costs, or factor in the possibility of a longer commute if it means achieving homeownership.

Look into government programs that can assist first-time homebuyers, or explore creative financing options. The California housing market remains a challenge, but with careful planning, a dose of perseverance, and a healthy dose of reality, homeownership can still be a dream within reach.

ALSO READ:

Will the California Housing Market Crash in 2024?